Page 42 - FINAL CFA II SLIDES JUNE 2019 DAY 8

P. 42

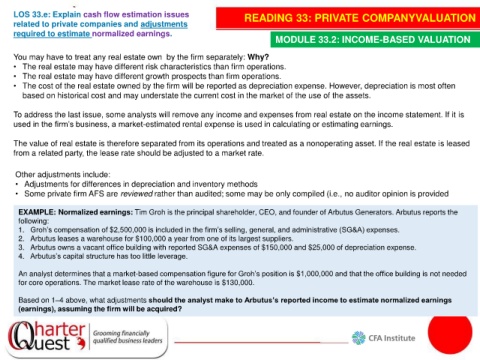

LOS 33.e: Explain cash flow estimation issues READING 33: PRIVATE COMPANYVALUATION

related to private companies and adjustments

required to estimate normalized earnings.

MODULE 33.2: INCOME-BASED VALUATION

You may have to treat any real estate own by the firm separately: Why?

• The real estate may have different risk characteristics than firm operations.

• The real estate may have different growth prospects than firm operations.

• The cost of the real estate owned by the firm will be reported as depreciation expense. However, depreciation is most often

based on historical cost and may understate the current cost in the market of the use of the assets.

To address the last issue, some analysts will remove any income and expenses from real estate on the income statement. If it is

used in the firm’s business, a market-estimated rental expense is used in calculating or estimating earnings.

The value of real estate is therefore separated from its operations and treated as a nonoperating asset. If the real estate is leased

from a related party, the lease rate should be adjusted to a market rate.

Other adjustments include:

• Adjustments for differences in depreciation and inventory methods

• Some private firm AFS are reviewed rather than audited; some may be only compiled (i.e., no auditor opinion is provided

EXAMPLE: Normalized earnings: Tim Groh is the principal shareholder, CEO, and founder of Arbutus Generators. Arbutus reports the

following:

1. Groh’s compensation of $2,500,000 is included in the firm’s selling, general, and administrative (SG&A) expenses.

2. Arbutus leases a warehouse for $100,000 a year from one of its largest suppliers.

3. Arbutus owns a vacant office building with reported SG&A expenses of $150,000 and $25,000 of depreciation expense.

4. Arbutus’s capital structure has too little leverage.

An analyst determines that a market-based compensation figure for Groh’s position is $1,000,000 and that the office building is not needed

for core operations. The market lease rate of the warehouse is $130,000.

Based on 1–4 above, what adjustments should the analyst make to Arbutus’s reported income to estimate normalized earnings

(earnings), assuming the firm will be acquired?