Page 47 - FINAL CFA II SLIDES JUNE 2019 DAY 8

P. 47

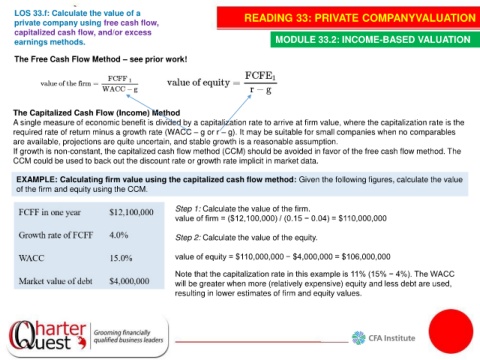

LOS 33.f: Calculate the value of a READING 33: PRIVATE COMPANYVALUATION

private company using free cash flow,

capitalized cash flow, and/or excess

earnings methods. MODULE 33.2: INCOME-BASED VALUATION

The Free Cash Flow Method – see prior work!

The Capitalized Cash Flow (Income) Method

A single measure of economic benefit is divided by a capitalization rate to arrive at firm value, where the capitalization rate is the

required rate of return minus a growth rate (WACC – g or r – g). It may be suitable for small companies when no comparables

are available, projections are quite uncertain, and stable growth is a reasonable assumption.

If growth is non-constant, the capitalized cash flow method (CCM) should be avoided in favor of the free cash flow method. The

CCM could be used to back out the discount rate or growth rate implicit in market data.

EXAMPLE: Calculating firm value using the capitalized cash flow method: Given the following figures, calculate the value

of the firm and equity using the CCM.

Step 1: Calculate the value of the firm.

value of firm = ($12,100,000) / (0.15 − 0.04) = $110,000,000

Step 2: Calculate the value of the equity.

value of equity = $110,000,000 − $4,000,000 = $106,000,000

Note that the capitalization rate in this example is 11% (15% − 4%). The WACC

will be greater when more (relatively expensive) equity and less debt are used,

resulting in lower estimates of firm and equity values.