Page 49 - FINAL CFA II SLIDES JUNE 2019 DAY 8

P. 49

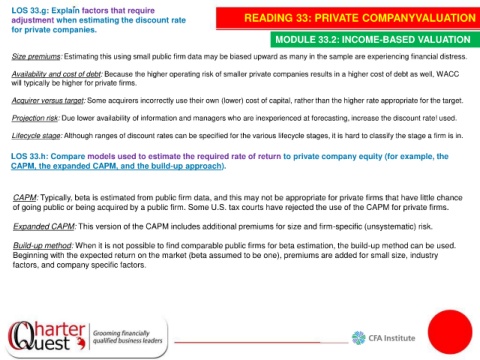

LOS 33.g: Explain factors that require

adjustment when estimating the discount rate READING 33: PRIVATE COMPANYVALUATION

for private companies.

MODULE 33.2: INCOME-BASED VALUATION

Size premiums: Estimating this using small public firm data may be biased upward as many in the sample are experiencing financial distress.

Availability and cost of debt: Because the higher operating risk of smaller private companies results in a higher cost of debt as well, WACC

will typically be higher for private firms.

Acquirer versus target: Some acquirers incorrectly use their own (lower) cost of capital, rather than the higher rate appropriate for the target.

Projection risk: Due lower availability of information and managers who are inexperienced at forecasting, increase the discount rate! used.

Lifecycle stage: Although ranges of discount rates can be specified for the various lifecycle stages, it is hard to classify the stage a firm is in.

LOS 33.h: Compare models used to estimate the required rate of return to private company equity (for example, the

CAPM, the expanded CAPM, and the build-up approach).

CAPM: Typically, beta is estimated from public firm data, and this may not be appropriate for private firms that have little chance

of going public or being acquired by a public firm. Some U.S. tax courts have rejected the use of the CAPM for private firms.

Expanded CAPM: This version of the CAPM includes additional premiums for size and firm-specific (unsystematic) risk.

Build-up method: When it is not possible to find comparable public firms for beta estimation, the build-up method can be used.

Beginning with the expected return on the market (beta assumed to be one), premiums are added for small size, industry

factors, and company specific factors.