Page 5 - FINAL CFA SLIDES DECEMBER 2018 DAY 12

P. 5

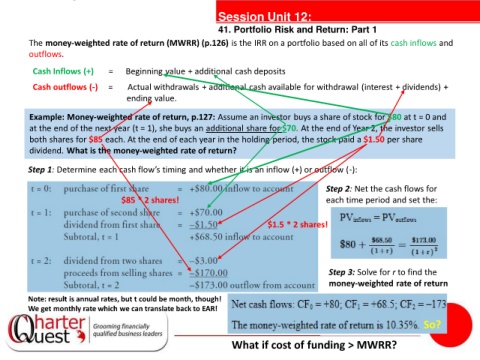

Session Unit 12:

41. Portfolio Risk and Return: Part 1

The money-weighted rate of return (MWRR) (p.126) is the IRR on a portfolio based on all of its cash inflows and

outflows.

Cash Inflows (+) = Beginning value + additional cash deposits

Cash outflows (-) = Actual withdrawals + additional cash available for withdrawal (interest + dividends) +

ending value.

Example: Money-weighted rate of return, p.127: Assume an investor buys a share of stock for $80 at t = 0 and

at the end of the next year (t = 1), she buys an additional share for $70. At the end of Year 2, the investor sells

both shares for $85 each. At the end of each year in the holding period, the stock paid a $1.50 per share

tanties

dividend. What is the money-weighted rate of return?

Step 1: Determine each cash flow’s timing and whether it is an inflow (+) or outflow (-):

Step 2: Net the cash flows for

$85 * 2 shares! each time period and set the:

$1.5 * 2 shares!

Step 3: Solve for r to find the

money-weighted rate of return

Note: result is annual rates, but t could be month, though!

We get monthly rate which we can translate back to EAR!

So?

What if cost of funding > MWRR?