Page 6 - FINAL CFA SLIDES DECEMBER 2018 DAY 12

P. 6

Session Unit 12:

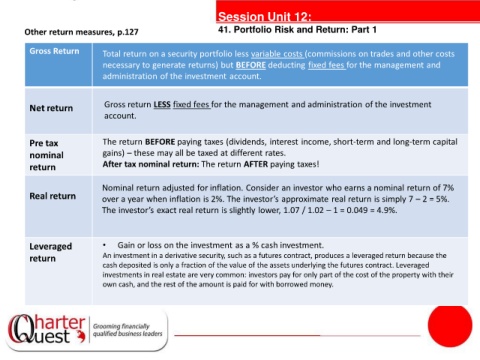

Other return measures, p.127 41. Portfolio Risk and Return: Part 1

Gross Return Total return on a security portfolio less variable costs (commissions on trades and other costs

necessary to generate returns) but BEFORE deducting fixed fees for the management and

administration of the investment account.

Net return Gross return LESS fixed fees for the management and administration of the investment

account.

Pre tax The return BEFORE paying taxes (dividends, interest income, short-term and long-term capital

tanties

nominal gains) – these may all be taxed at different rates.

return After tax nominal return: The return AFTER paying taxes!

Nominal return adjusted for inflation. Consider an investor who earns a nominal return of 7%

Real return over a year when inflation is 2%. The investor’s approximate real return is simply 7 – 2 = 5%.

The investor’s exact real return is slightly lower, 1.07 / 1.02 – 1 = 0.049 = 4.9%.

Leveraged • Gain or loss on the investment as a % cash investment.

return An investment in a derivative security, such as a futures contract, produces a leveraged return because the

cash deposited is only a fraction of the value of the assets underlying the futures contract. Leveraged

investments in real estate are very common: investors pay for only part of the cost of the property with their

own cash, and the rest of the amount is paid for with borrowed money.