Page 36 - Chapters 17 & 18 - Dividends & Dividend Tax

P. 36

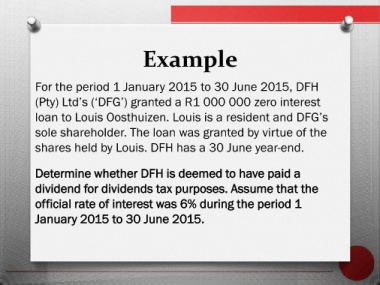

Example

For the period 1 January 2015 to 30 June 2015, DFH

(Pty) Ltd’s (‘DFG’) granted a R1 000 000 zero interest

loan to Louis Oosthuizen. Louis is a resident and DFG’s

sole shareholder. The loan was granted by virtue of the

shares held by Louis. DFH has a 30 June year-end.

Determine whether DFH is deemed to have paid a

dividend for dividends tax purposes. Assume that the

official rate of interest was 6% during the period 1

January 2015 to 30 June 2015.