Page 40 - Chapters 17 & 18 - Dividends & Dividend Tax

P. 40

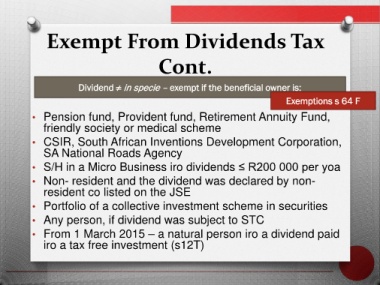

Exempt From Dividends Tax

Cont.

Dividend ≠ in specie – exempt if the beneficial owner is:

Exemptions s 64 F

• Pension fund, Provident fund, Retirement Annuity Fund,

friendly society or medical scheme

• CSIR, South African Inventions Development Corporation,

SA National Roads Agency

• S/H in a Micro Business iro dividends ≤ R200 000 per yoa

• Non- resident and the dividend was declared by non-

resident co listed on the JSE

• Portfolio of a collective investment scheme in securities

• Any person, if dividend was subject to STC

• From 1 March 2015 – a natural person iro a dividend paid

iro a tax free investment (s12T)