Page 6 - Chapters 17 & 18 - Dividends & Dividend Tax

P. 6

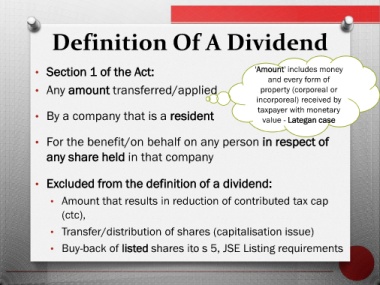

Definition Of A Dividend

• Section 1 of the Act: 'Amount' includes money

and every form of

• Any amount transferred/applied property (corporeal or

incorporeal) received by

• By a company that is a resident taxpayer with monetary

value - Lategan case

• For the benefit/on behalf on any person in respect of

any share held in that company

• Excluded from the definition of a dividend:

• Amount that results in reduction of contributed tax cap

(ctc),

• Transfer/distribution of shares (capitalisation issue)

• Buy-back of listed shares ito s 5, JSE Listing requirements