Page 8 - Chapters 17 & 18 - Dividends & Dividend Tax

P. 8

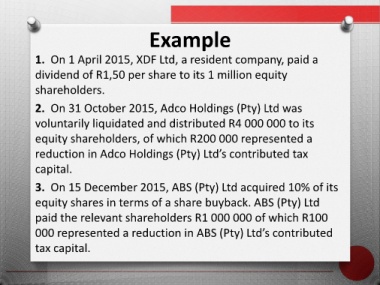

Example

1. On 1 April 2015, XDF Ltd, a resident company, paid a

dividend of R1,50 per share to its 1 million equity

shareholders.

2. On 31 October 2015, Adco Holdings (Pty) Ltd was

voluntarily liquidated and distributed R4 000 000 to its

equity shareholders, of which R200 000 represented a

reduction in Adco Holdings (Pty) Ltd’s contributed tax

capital.

3. On 15 December 2015, ABS (Pty) Ltd acquired 10% of its

equity shares in terms of a share buyback. ABS (Pty) Ltd

paid the relevant shareholders R1 000 000 of which R100

000 represented a reduction in ABS (Pty) Ltd’s contributed

tax capital.