Page 16 - FINAL CFA SLIDES DECEMBER 2018 DAY 14

P. 16

Session Unit 14:

49. Equity Valuation: Concepts and Basic Tools

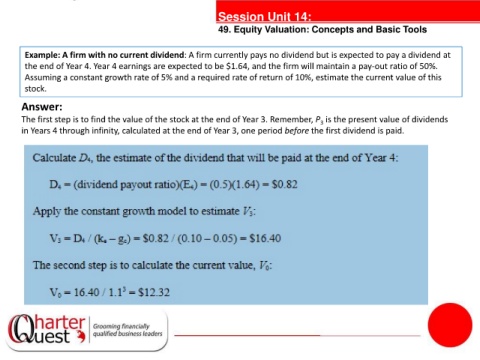

Example: A firm with no current dividend: A firm currently pays no dividend but is expected to pay a dividend at

the end of Year 4. Year 4 earnings are expected to be $1.64, and the firm will maintain a pay-out ratio of 50%.

Assuming a constant growth rate of 5% and a required rate of return of 10%, estimate the current value of this

stock.

Answer:

The first step is to find the value of the stock at the end of Year 3. Remember, P is the present value of dividends

3

in Years 4 through infinity, calculated at the end of Year 3, one period before the first dividend is paid.

tanties