Page 21 - FINAL CFA SLIDES DECEMBER 2018 DAY 14

P. 21

Session Unit 14:

49. Equity Valuation: Concepts and Basic Tools

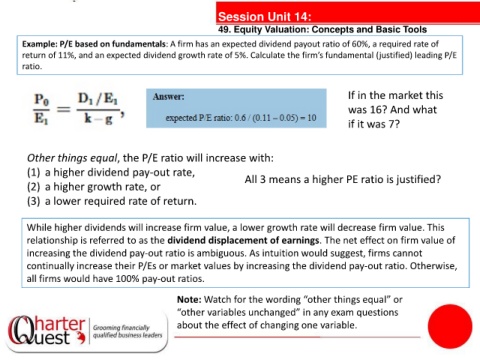

Example: P/E based on fundamentals: A firm has an expected dividend payout ratio of 60%, a required rate of

return of 11%, and an expected dividend growth rate of 5%. Calculate the firm’s fundamental (justified) leading P/E

ratio.

If in the market this

was 16? And what

if it was 7?

tanties

Other things equal, the P/E ratio will increase with:

(1) a higher dividend pay-out rate, All 3 means a higher PE ratio is justified?

(2) a higher growth rate, or

(3) a lower required rate of return.

While higher dividends will increase firm value, a lower growth rate will decrease firm value. This

relationship is referred to as the dividend displacement of earnings. The net effect on firm value of

increasing the dividend pay-out ratio is ambiguous. As intuition would suggest, firms cannot

continually increase their P/Es or market values by increasing the dividend pay-out ratio. Otherwise,

all firms would have 100% pay-out ratios.

Note: Watch for the wording “other things equal” or

“other variables unchanged” in any exam questions

about the effect of changing one variable.