Page 65 - CFA Lecture Day 9 Slides

P. 65

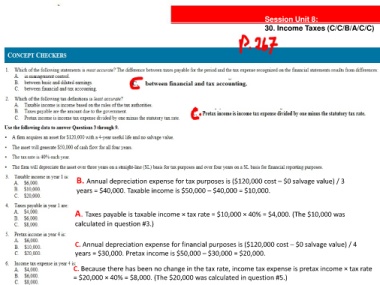

Session Unit 8:

30. Income Taxes (C/C/B/A/C/C)

8

tanties

B. Annual depreciation expense for tax purposes is ($120,000 cost – $0 salvage value) / 3

years = $40,000. Taxable income is $50,000 – $40,000 = $10,000.

A. Taxes payable is taxable income × tax rate = $10,000 × 40% = $4,000. (The $10,000 was

calculated in question #3.)

C. Annual depreciation expense for financial purposes is ($120,000 cost – $0 salvage value) / 4

years = $30,000. Pretax income is $50,000 – $30,000 = $20,000.

C. Because there has been no change in the tax rate, income tax expense is pretax income × tax rate

= $20,000 × 40% = $8,000. (The $20,000 was calculated in question #5.)