Page 66 - CFA Lecture Day 9 Slides

P. 66

Session Unit 8:

30. Income Taxes (C/C/C/B/A/A/C/C/B)

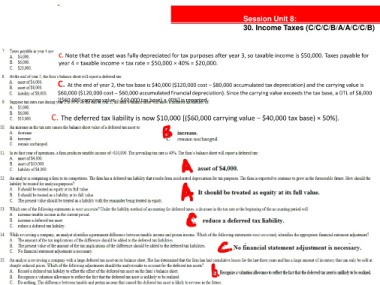

C. Note that the asset was fully depreciated for tax purposes after year 3, so taxable income is $50,000. Taxes payable for

year 4 = taxable income × tax rate = $50,000 × 40% = $20,000.

C. At the end of year 2, the tax base is $40,000 ($120,000 cost – $80,000 accumulated tax depreciation) and the carrying value is

$60,000 ($120,000 cost – $60,000 accumulated financial depreciation). Since the carrying value exceeds the tax base, a DTL of $8,000

[($60,000 carrying value – $40,000 tax base) × 40%] is reported.

tanties

C. The deferred tax liability is now $10,000 [($60,000 carrying value – $40,000 tax base) × 50%].