Page 16 - FINAL CFA SLIDES DECEMBER 2018 DAY 6

P. 16

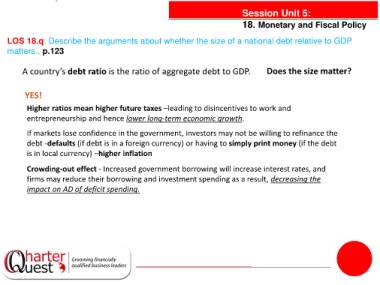

Session Unit 5:

18. Monetary and Fiscal Policy

LOS 18.q: Describe the arguments about whether the size of a national debt relative to GDP

matters., p.123

A country’s debt ratio is the ratio of aggregate debt to GDP. Does the size matter?

YES!

Higher ratios mean higher future taxes –leading to disincentives to work and

entrepreneurship and hence lower long-term economic growth.

If markets lose confidence in the government, investors may not be willing to refinance the

debt -defaults (if debt is in a foreign currency) or having to simply print money (if the debt

is in local currency) –higher inflation

Crowding-out effect - Increased government borrowing will increase interest rates, and

firms may reduce their borrowing and investment spending as a result, decreasing the

impact on AD of deficit spending.