Page 17 - FINAL CFA SLIDES DECEMBER 2018 DAY 6

P. 17

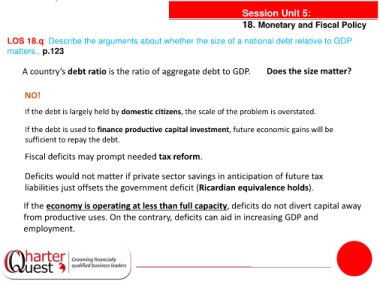

Session Unit 5:

18. Monetary and Fiscal Policy

LOS 18.q: Describe the arguments about whether the size of a national debt relative to GDP

matters., p.123

A country’s debt ratio is the ratio of aggregate debt to GDP. Does the size matter?

NO!

If the debt is largely held by domestic citizens, the scale of the problem is overstated.

If the debt is used to finance productive capital investment, future economic gains will be

sufficient to repay the debt.

Fiscal deficits may prompt needed tax reform.

Deficits would not matter if private sector savings in anticipation of future tax

liabilities just offsets the government deficit (Ricardian equivalence holds).

If the economy is operating at less than full capacity, deficits do not divert capital away

from productive uses. On the contrary, deficits can aid in increasing GDP and

employment.