Page 69 - Companies & Dividend Tax

P. 69

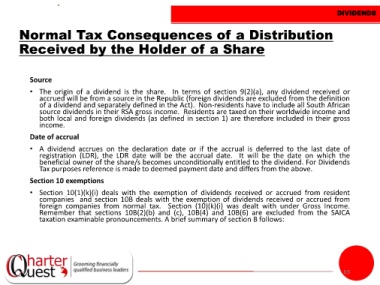

DIVIDENDS

Normal Tax Consequences of a Distribution

Received by the Holder of a Share

Source

• The origin of a dividend is the share. In terms of section 9(2)(a), any dividend received or

accrued will be from a source in the Republic (foreign dividends are excluded from the definition

of a dividend and separately defined in the Act). Non-residents have to include all South African

source dividends in their RSA gross income. Residents are taxed on their worldwide income and

both local and foreign dividends (as defined in section 1) are therefore included in their gross

income.

Date of accrual

• A dividend accrues on the declaration date or if the accrual is deferred to the last date of

registration (LDR), the LDR date will be the accrual date. It will be the date on which the

beneficial owner of the share/s becomes unconditionally entitled to the dividend. For Dividends

Tax purposes reference is made to deemed payment date and differs from the above.

Section 10 exemptions

• Section 10(1)(k)(i) deals with the exemption of dividends received or accrued from resident

companies and section 10B deals with the exemption of dividends received or accrued from

foreign companies from normal tax. Section (10)(k)(i) was dealt with under Gross Income.

Remember that sections 10B(2)(b) and (c), 10B(4) and 10B(6) are excluded from the SAICA

taxation examinable pronouncements. A brief summary of section B follows:

69