Page 72 - Companies & Dividend Tax

P. 72

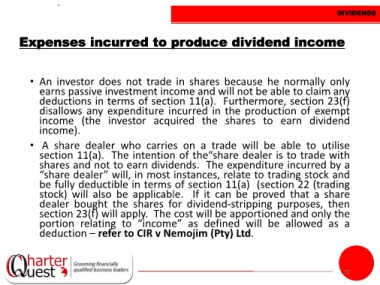

DIVIDENDS

Expenses incurred to produce dividend income

• An investor does not trade in shares because he normally only

earns passive investment income and will not be able to claim any

deductions in terms of section 11(a). Furthermore, section 23(f)

disallows any expenditure incurred in the production of exempt

income (the investor acquired the shares to earn dividend

income).

• A share dealer who carries on a trade will be able to utilise

section 11(a). The intention of the“share dealer is to trade with

shares and not to earn dividends. The expenditure incurred by a

“share dealer” will, in most instances, relate to trading stock and

be fully deductible in terms of section 11(a) (section 22 (trading

stock) will also be applicable. If it can be proved that a share

dealer bought the shares for dividend-stripping purposes, then

section 23(f) will apply. The cost will be apportioned and only the

portion relating to “income” as defined will be allowed as a

deduction – refer to CIR v Nemojim (Pty) Ltd.

72