Page 5 - FINAL CFA SLIDES DECEMBER 2018 DAY 13

P. 5

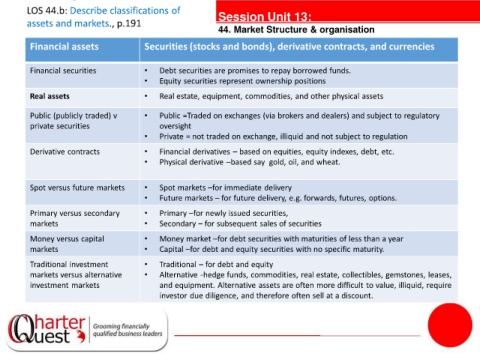

LOS 44.b: Describe classifications of Session Unit 13:

assets and markets., p.191

44. Market Structure & organisation

Financial assets Securities (stocks and bonds), derivative contracts, and currencies

Financial securities • Debt securities are promises to repay borrowed funds.

• Equity securities represent ownership positions

Real assets • Real estate, equipment, commodities, and other physical assets

Public (publicly traded) v • Public =Traded on exchanges (via brokers and dealers) and subject to regulatory

private securities oversight

• Private = not traded on exchange, illiquid and not subject to regulation

tanties

Derivative contracts • Financial derivatives – based on equities, equity indexes, debt, etc.

• Physical derivative –based say gold, oil, and wheat.

Spot versus future markets • Spot markets –for immediate delivery

• Future markets – for future delivery, e.g. forwards, futures, options.

Primary versus secondary • Primary –for newly issued securities,

markets • Secondary – for subsequent sales of securities

Money versus capital • Money market –for debt securities with maturities of less than a year

markets • Capital –for debt and equity securities with no specific maturity.

Traditional investment • Traditional – for debt and equity

markets versus alternative • Alternative -hedge funds, commodities, real estate, collectibles, gemstones, leases,

investment markets and equipment. Alternative assets are often more difficult to value, illiquid, require

investor due diligence, and therefore often sell at a discount.