Page 7 - FINAL CFA SLIDES DECEMBER 2018 DAY 13

P. 7

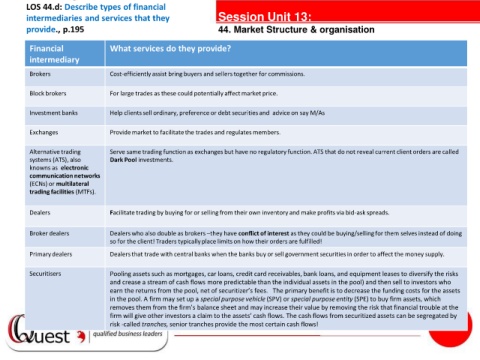

LOS 44.d: Describe types of financial

intermediaries and services that they Session Unit 13:

provide., p.195 44. Market Structure & organisation

Financial What services do they provide?

intermediary

Brokers Cost-efficiently assist bring buyers and sellers together for commissions.

Block brokers For large trades as these could potentially affect market price.

Investment banks Help clients sell ordinary, preference or debt securities and advice on say M/As

Exchanges Provide market to facilitate the trades and regulates members.

Alternative trading Serve same trading function as exchanges but have no regulatory function. ATS that do not reveal current client orders are called

systems (ATS), also Dark Pool investments. tanties

knowns as electronic

communication networks

(ECNs) or multilateral

trading facilities (MTFs).

Dealers Facilitate trading by buying for or selling from their own inventory and make profits via bid-ask spreads.

Broker dealers Dealers who also double as brokers –they have conflict of interest as they could be buying/selling for them selves instead of doing

so for the client! Traders typically place limits on how their orders are fulfilled!

Primary dealers Dealers that trade with central banks when the banks buy or sell government securities in order to affect the money supply.

Securitisers Pooling assets such as mortgages, car loans, credit card receivables, bank loans, and equipment leases to diversify the risks

and crease a stream of cash flows more predictable than the individual assets in the pool) and then sell to investors who

earn the returns from the pool, net of securitizer’s fees. The primary benefit is to decrease the funding costs for the assets

in the pool. A firm may set up a special purpose vehicle (SPV) or special purpose entity (SPE) to buy firm assets, which

removes them from the firm’s balance sheet and may increase their value by removing the risk that financial trouble at the

firm will give other investors a claim to the assets’ cash flows. The cash flows from securitized assets can be segregated by

risk -called tranches, senior tranches provide the most certain cash flows!