Page 31 - FINAL CFA II SLIDES JUNE 2019 DAY 7

P. 31

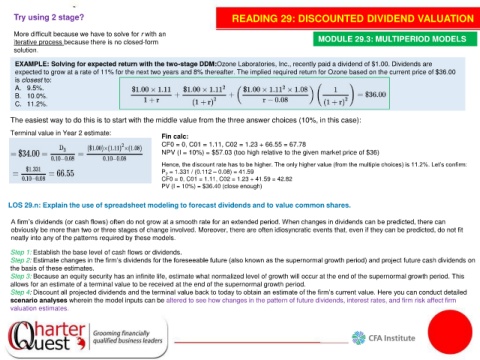

Try using 2 stage? READING 29: DISCOUNTED DIVIDEND VALUATION

More difficult because we have to solve for r with an

iterative process because there is no closed-form MODULE 29.3: MULTIPERIOD MODELS

solution.

EXAMPLE: Solving for expected return with the two-stage DDM:Ozone Laboratories, Inc., recently paid a dividend of $1.00. Dividends are

expected to grow at a rate of 11% for the next two years and 8% thereafter. The implied required return for Ozone based on the current price of $36.00

is closest to:

A. 9.5%.

B. 10.0%.

C. 11.2%.

The easiest way to do this is to start with the middle value from the three answer choices (10%, in this case):

Terminal value in Year 2 estimate:

Fin calc:

CF0 = 0, C01 = 1.11, C02 = 1.23 + 66.55 = 67.78

NPV (I = 10%) = $57.03 (too high relative to the given market price of $36)

Hence, the discount rate has to be higher. The only higher value (from the multiple choices) is 11.2%. Let’s confirm:

P = 1.331 / (0.112 – 0.08) = 41.59

2

CF0 = 0, C01 = 1.11, C02 = 1.23 + 41.59 = 42.82

PV (I = 10%) = $36.40 (close enough)

LOS 29.n: Explain the use of spreadsheet modeling to forecast dividends and to value common shares.

A firm’s dividends (or cash flows) often do not grow at a smooth rate for an extended period. When changes in dividends can be predicted, there can

obviously be more than two or three stages of change involved. Moreover, there are often idiosyncratic events that, even if they can be predicted, do not fit

neatly into any of the patterns required by these models.

Step 1: Establish the base level of cash flows or dividends.

Step 2: Estimate changes in the firm’s dividends for the foreseeable future (also known as the supernormal growth period) and project future cash dividends on

the basis of these estimates.

Step 3: Because an equity security has an infinite life, estimate what normalized level of growth will occur at the end of the supernormal growth period. This

allows for an estimate of a terminal value to be received at the end of the supernormal growth period.

Step 4: Discount all projected dividends and the terminal value back to today to obtain an estimate of the firm’s current value. Here you can conduct detailed

scenario analyses wherein the model inputs can be altered to see how changes in the pattern of future dividends, interest rates, and firm risk affect firm

valuation estimates.