Page 19 - Test 1 Slides - 4. Gross Income

P. 19

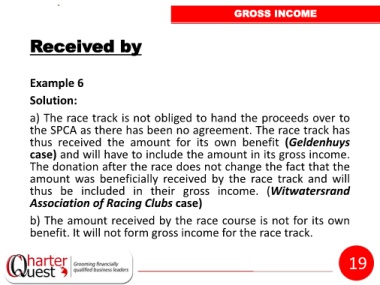

GROSS INCOME

Received by

Example 6

Solution:

a) The race track is not obliged to hand the proceeds over to

the SPCA as there has been no agreement. The race track has

thus received the amount for its own benefit (Geldenhuys

case) and will have to include the amount in its gross income.

The donation after the race does not change the fact that the

amount was beneficially received by the race track and will

thus be included in their gross income. (Witwatersrand

Association of Racing Clubs case)

b) The amount received by the race course is not for its own

benefit. It will not form gross income for the race track.

19