Page 14 - Test 1 Slides - 4. Gross Income

P. 14

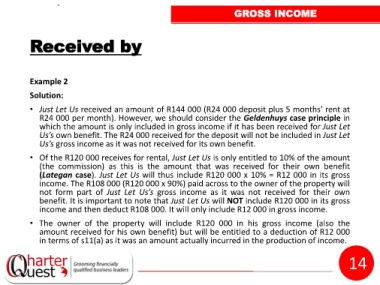

GROSS INCOME

Received by

Example 2

Solution:

• Just Let Us received an amount of R144 000 (R24 000 deposit plus 5 months’ rent at

R24 000 per month). However, we should consider the Geldenhuys case principle in

which the amount is only included in gross income if it has been received for Just Let

Us’s own benefit. The R24 000 received for the deposit will not be included in Just Let

Us’s gross income as it was not received for its own benefit.

• Of the R120 000 receives for rental, Just Let Us is only entitled to 10% of the amount

(the commission) as this is the amount that was received for their own benefit

(Lategan case). Just Let Us will thus include R120 000 x 10% = R12 000 in its gross

income. The R108 000 (R120 000 x 90%) paid across to the owner of the property will

not form part of Just Let Us’s gross income as it was not received for their own

benefit. It is important to note that Just Let Us will NOT include R120 000 in its gross

income and then deduct R108 000. It will only include R12 000 in gross income.

• The owner of the property will include R120 000 in his gross income (also the

amount received for his own benefit) but will be entitled to a deduction of R12 000

in terms of s11(a) as it was an amount actually incurred in the production of income.

14