Page 9 - Test 1 Slides - 4. Gross Income

P. 9

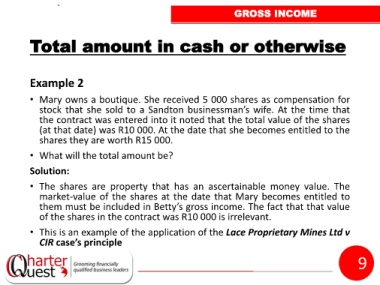

GROSS INCOME

Total amount in cash or otherwise

Example 2

• Mary owns a boutique. She received 5 000 shares as compensation for

stock that she sold to a Sandton businessman’s wife. At the time that

the contract was entered into it noted that the total value of the shares

(at that date) was R10 000. At the date that she becomes entitled to the

shares they are worth R15 000.

• What will the total amount be?

Solution:

• The shares are property that has an ascertainable money value. The

market-value of the shares at the date that Mary becomes entitled to

them must be included in Betty’s gross income. The fact that that value

of the shares in the contract was R10 000 is irrelevant.

• This is an example of the application of the Lace Proprietary Mines Ltd v

CIR case’s principle

9