Page 12 - Test 1 Slides - 4. Gross Income

P. 12

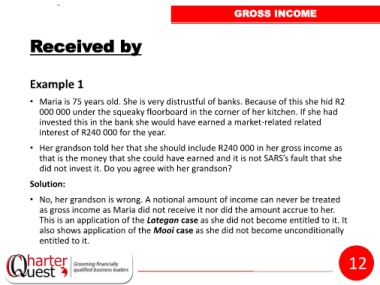

GROSS INCOME

Received by

Example 1

• Maria is 75 years old. She is very distrustful of banks. Because of this she hid R2

000 000 under the squeaky floorboard in the corner of her kitchen. If she had

invested this in the bank she would have earned a market-related related

interest of R240 000 for the year.

• Her grandson told her that she should include R240 000 in her gross income as

that is the money that she could have earned and it is not SARS’s fault that she

did not invest it. Do you agree with her grandson?

Solution:

• No, her grandson is wrong. A notional amount of income can never be treated

as gross income as Maria did not receive it nor did the amount accrue to her.

This is an application of the Lategan case as she did not become entitled to it. It

also shows application of the Mooi case as she did not become unconditionally

entitled to it.

12