Page 311 - AFM Integrated Workbook STUDENT S18-J19

P. 311

Corporate failure and reconstruction

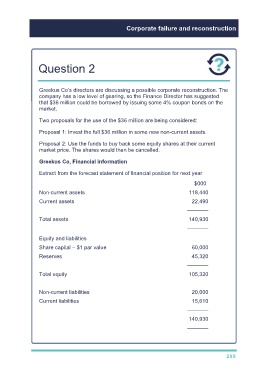

Question 2

Greekus Co’s directors are discussing a possible corporate reconstruction. The

company has a low level of gearing, so the Finance Director has suggested

that $36 million could be borrowed by issuing some 4% coupon bonds on the

market.

Two proposals for the use of the $36 million are being considered:

Proposal 1: Invest the full $36 million in some new non-current assets.

Proposal 2: Use the funds to buy back some equity shares at their current

market price. The shares would then be cancelled.

Greekus Co, Financial information

Extract from the forecast statement of financial position for next year

$000

Non-current assets 118,440

Current assets 22,490

–––––––

Total assets 140,930

–––––––

Equity and liabilities

Share capital – $1 par value 60,000

Reserves 45,320

–––––––

Total equity 105,320

Non-current liabilities 20,000

Current liabilities 15,610

–––––––

140,930

–––––––

299