Page 464 - Microsoft Word - 00 CIMA F1 Prelims STUDENT 2018.docx

P. 464

Chapter 25

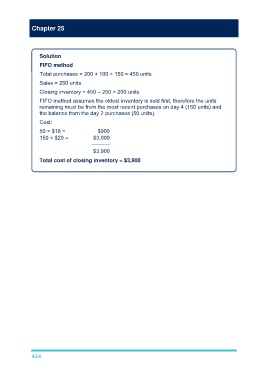

Solution

FIFO method

Total purchases = 200 + 100 + 150 = 450 units

Sales = 250 units

Closing inventory = 450 – 250 = 200 units

FIFO method assumes the oldest inventory is sold first, therefore the units

remaining must be from the most recent purchases on day 4 (150 units) and

the balance from the day 2 purchases (50 units).

Cost:

50 × $18 = $900

150 × $20 = $3,000

––––––

$3,900

Total cost of closing inventory = $3,900

454