Page 469 - Microsoft Word - 00 CIMA F1 Prelims STUDENT 2018.docx

P. 469

Answers

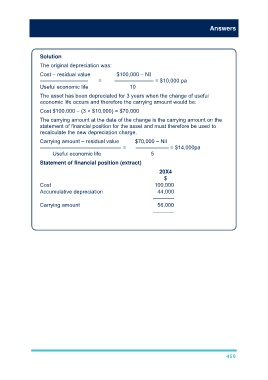

Solution

The original depreciation was:

Cost – residual value $100,000 – Nil

–––––––––––––––– = ––––––––––––– = $10,000 pa

Useful economic life 10

The asset has been depreciated for 3 years when the change of useful

economic life occurs and therefore the carrying amount would be:

Cost $100,000 – (3 × $10,000) = $70,000

The carrying amount at the date of the change is the carrying amount on the

statement of financial position for the asset and must therefore be used to

recalculate the new depreciation charge.

Carrying amount – residual value $70,000 – Nil

––––––––––––––––––––––––––– = ––––––––––– = $14,000pa

Useful economic life 5

Statement of financial position (extract)

20X4

$

Cost 100,000

Accumulative depreciation 44,000

–––––––

Carrying amount 56,000

–––––––

459