Page 497 - Microsoft Word - 00 CIMA F1 Prelims STUDENT 2018.docx

P. 497

Answers

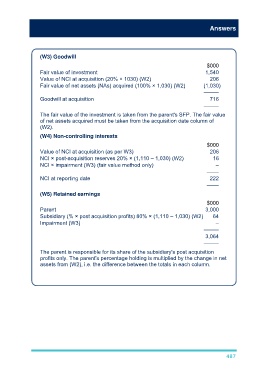

(W3) Goodwill

$000

Fair value of investment 1,540

Value of NCI at acquisition (20% × 1030) (W2) 206

Fair value of net assets (NAs) acquired (100% × 1,030) (W2) (1,030)

–––––

Goodwill at acquisition 716

–––––

The fair value of the investment is taken from the parent's SFP. The fair value

of net assets acquired must be taken from the acquisition date column of

(W2).

(W4) Non-controlling interests

$000

Value of NCI at acquisition (as per W3) 206

NCI × post-acquisition reserves 20% × (1,110 – 1,030) (W2) 16

NCI × impairment (W3) (fair value method only) –

––––

NCI at reporting date 222

––––

(W5) Retained earnings

$000

Parent 3,000

Subsidiary (% × post acquisition profits) 80% × (1,110 – 1,030) (W2) 64

Impairment (W3) –

–––––

3,064

–––––

The parent is responsible for its share of the subsidiary's post acquisition

profits only. The parent's percentage holding is multiplied by the change in net

assets from (W2), i.e. the difference between the totals in each column.

487