Page 6 - Non-residence taxation

P. 6

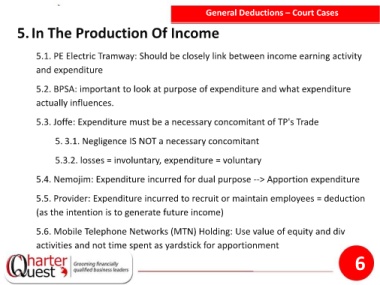

General Deductions – Court Cases

5.In The Production Of Income

5.1. PE Electric Tramway: Should be closely link between income earning activity

and expenditure

5.2. BPSA: important to look at purpose of expenditure and what expenditure

actually influences.

5.3. Joffe: Expenditure must be a necessary concomitant of TP's Trade

5. 3.1. Negligence IS NOT a necessary concomitant

5.3.2. losses = involuntary, expenditure = voluntary

5.4. Nemojim: Expenditure incurred for dual purpose --> Apportion expenditure

5.5. Provider: Expenditure incurred to recruit or maintain employees = deduction

(as the intention is to generate future income)

5.6. Mobile Telephone Networks (MTN) Holding: Use value of equity and div

activities and not time spent as yardstick for apportionment

6