Page 7 - Non-residence taxation

P. 7

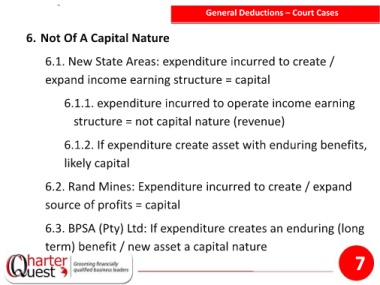

General Deductions – Court Cases

6. Not Of A Capital Nature

6.1. New State Areas: expenditure incurred to create /

expand income earning structure = capital

6.1.1. expenditure incurred to operate income earning

structure = not capital nature (revenue)

6.1.2. If expenditure create asset with enduring benefits,

likely capital

6.2. Rand Mines: Expenditure incurred to create / expand

source of profits = capital

6.3. BPSA (Pty) Ltd: If expenditure creates an enduring (long

term) benefit / new asset a capital nature

7