Page 387 - F2 Integrated Workbook STUDENT 2019

P. 387

Analysis of financial performance and position

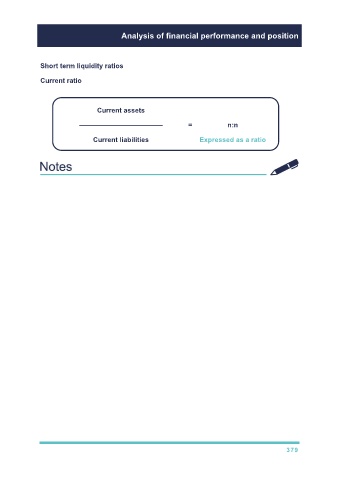

Short term liquidity ratios

Current ratio

Current assets

–––––––––––––––––––––– = n:n

Current liabilities Expressed as a ratio

TUTOR GUIDANCE

Healthy level typically considered as 2:1.

If too low – may not be able to repay creditors, risk of being forced into

liquidation.

If too high may suggest:

– obsolete inventory

– poor credit control

– poor cash management.

Must consider industry averages when determining a healthy current ratios

e.g. retailers will have lower CR than manufacturers.

379