Page 391 - F2 Integrated Workbook STUDENT 2019

P. 391

Analysis of financial performance and position

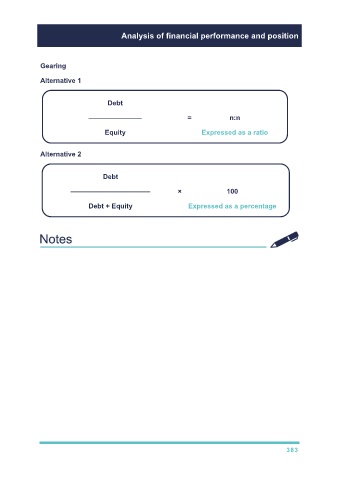

Gearing

Alternative 1

Debt

–––––––––––––– = n:n

Equity Expressed as a ratio

Alternative 2

Debt

––––––––––––––––––––– × 100

Debt + Equity Expressed as a percentage

TUTOR GUIDANCE

Gearing is used to determine risk associated with an entity.

If an entity is highly geared there is a greater risk of:

– failing to service the entity’s debt finance (pay the interest)

– having finance withdrawn

– failing to obtain further finance from new financiers.

Comparison to industry averages would be required to determine if gearing is

deemed high.

383