Page 453 - F2 Integrated Workbook STUDENT 2019

P. 453

Answers

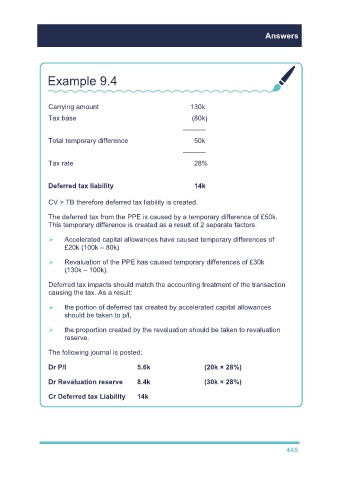

Example 9.4

Carrying amount 130k

Tax base (80k)

––––––

Total temporary difference 50k

––––––

Tax rate 28%

Deferred tax liability 14k

CV > TB therefore deferred tax liability is created.

The deferred tax from the PPE is caused by a temporary difference of £50k.

This temporary difference is created as a result of 2 separate factors.

Accelerated capital allowances have caused temporary differences of

£20k (100k – 80k)

Revaluation of the PPE has caused temporary differences of £30k

(130k – 100k).

Deferred tax impacts should match the accounting treatment of the transaction

causing the tax. As a result:

the portion of deferred tax created by accelerated capital allowances

should be taken to p/l,

the proportion created by the revaluation should be taken to revaluation

reserve.

The following journal is posted:

Dr P/l 5.6k (20k × 28%)

Dr Revaluation reserve 8.4k (30k × 28%)

Cr Deferred tax Liability 14k

445