Page 503 - F2 Integrated Workbook STUDENT 2019

P. 503

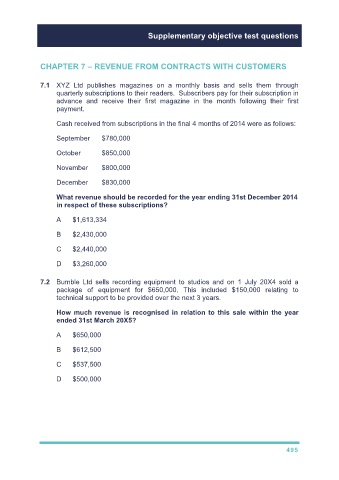

Supplementary objective test questions

CHAPTER 7 – REVENUE FROM CONTRACTS WITH CUSTOMERS

7.1 XYZ Ltd publishes magazines on a monthly basis and sells them through

quarterly subscriptions to their readers. Subscribers pay for their subscription in

advance and receive their first magazine in the month following their first

payment.

Cash received from subscriptions in the final 4 months of 2014 were as follows:

September $780,000

October $850,000

November $800,000

December $830,000

What revenue should be recorded for the year ending 31st December 2014

in respect of these subscriptions?

A $1,613,334

B $2,430,000

C $2,440,000

D $3,260,000

7.2 Bumble Ltd sells recording equipment to studios and on 1 July 20X4 sold a

package of equipment for $650,000. This included $150,000 relating to

technical support to be provided over the next 3 years.

How much revenue is recognised in relation to this sale within the year

ended 31st March 20X5?

A $650,000

B $612,500

C $537,500

D $500,000

495