Page 190 - F3 -FA Integrated Workbook STUDENT 2018-19

P. 190

Chapter 13

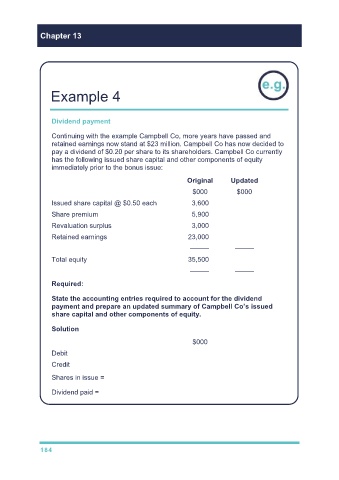

Example 4

Dividend payment

Continuing with the example Campbell Co, more years have passed and

retained earnings now stand at $23 million. Campbell Co has now decided to

pay a dividend of $0.20 per share to its shareholders. Campbell Co currently

has the following issued share capital and other components of equity

immediately prior to the bonus issue:

Original Updated

$000 $000

Issued share capital @ $0.50 each 3,600 3,600

Share premium 5,900 5,900

Revaluation surplus 3,000 3,000

Retained earnings 23,000 21,560

––––– –––––

Total equity 35,500 34,060

––––– –––––

Required:

State the accounting entries required to account for the dividend

payment and prepare an updated summary of Campbell Co’s issued

share capital and other components of equity.

Solution

$000

Debit Retained earnings 1,440

Credit Cash paid 1,440

Shares in issue = 3.6m × 2 = 7.2m

Dividend paid = 7.2m × $0.20 = $1.44m

184