Page 261 - F3 -FA Integrated Workbook STUDENT 2018-19

P. 261

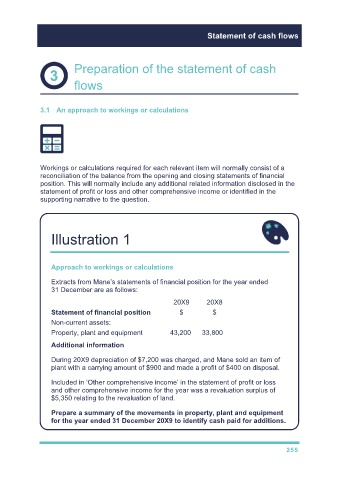

Statement of cash flows

Preparation of the statement of cash

flows

3.1 An approach to workings or calculations

Workings or calculations required for each relevant item will normally consist of a

reconciliation of the balance from the opening and closing statements of financial

position. This will normally include any additional related information disclosed in the

statement of profit or loss and other comprehensive income or identified in the

supporting narrative to the question.

Illustration 1

Approach to workings or calculations

Extracts from Mane’s statements of financial position for the year ended

31 December are as follows:

20X9 20X8

Statement of financial position $ $

Non-current assets:

Property, plant and equipment 43,200 33,800

Additional information

During 20X9 depreciation of $7,200 was charged, and Mane sold an item of

plant with a carrying amount of $900 and made a profit of $400 on disposal.

Included in ‘Other comprehensive income’ in the statement of profit or loss

and other comprehensive income for the year was a revaluation surplus of

$5,350 relating to the revaluation of land.

Prepare a summary of the movements in property, plant and equipment

for the year ended 31 December 20X9 to identify cash paid for additions.

255