Page 264 - F3 -FA Integrated Workbook STUDENT 2018-19

P. 264

Chapter 19

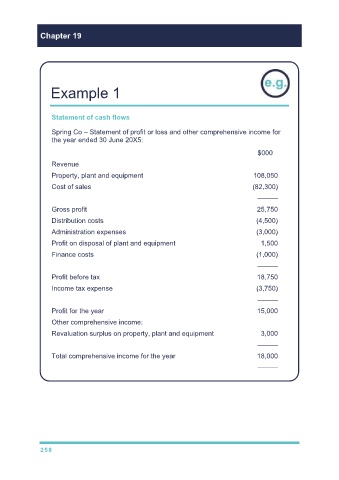

Example 1

Statement of cash flows

Spring Co – Statement of profit or loss and other comprehensive income for

the year ended 30 June 20X5:

$000

Revenue

Property, plant and equipment 108,050

Cost of sales (82,300)

———

Gross profit 25,750

Distribution costs (4,500)

Administration expenses (3,000)

Profit on disposal of plant and equipment 1,500

Finance costs (1,000)

———

Profit before tax 18,750

Income tax expense (3,750)

———

Profit for the year 15,000

Other comprehensive income:

Revaluation surplus on property, plant and equipment 3,000

———

Total comprehensive income for the year 18,000

———

258