Page 268 - F3 -FA Integrated Workbook STUDENT 2018-19

P. 268

Chapter 19

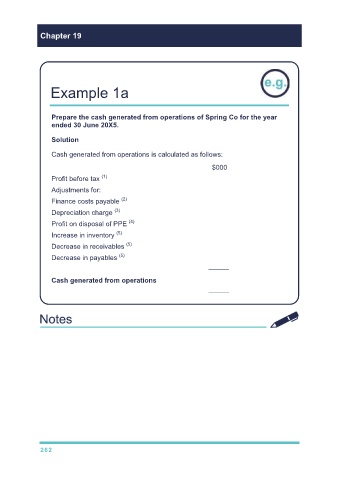

Example 1a

Prepare the cash generated from operations of Spring Co for the year

ended 30 June 20X5.

Solution

Cash generated from operations is calculated as follows:

$000

(1)

Profit before tax 18,750

Adjustments for:

(2)

Finance costs payable 1,000

(3)

Depreciation charge 3,500

(4)

Profit on disposal of PPE (1,500)

(5)

Increase in inventory (38,250 – 35,700) (2,550)

(5)

Decrease in receivables (34,750 – 42,600) 7,850

(5)

Decrease in payables (25,100 – 33,000) (7,900)

———

Cash generated from operations 19,150

———

262