Page 345 - F3 -FA Integrated Workbook STUDENT 2018-19

P. 345

Consolidated financial statements II

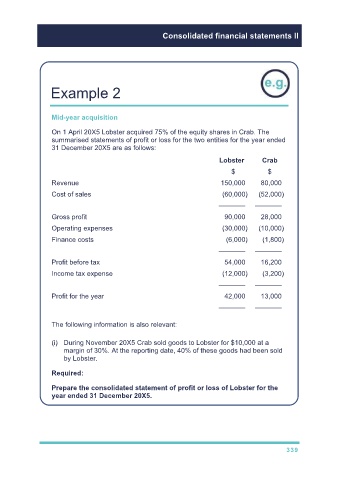

Example 2

Mid-year acquisition

On 1 April 20X5 Lobster acquired 75% of the equity shares in Crab. The

summarised statements of profit or loss for the two entities for the year ended

31 December 20X5 are as follows:

Lobster Crab

$ $

Revenue 150,000 80,000

Cost of sales (60,000) (52,000)

––––––– –––––––

Gross profit 90,000 28,000

Operating expenses (30,000) (10,000)

Finance costs (6,000) (1,800)

––––––– –––––––

Profit before tax 54,000 16,200

Income tax expense (12,000) (3,200)

––––––– –––––––

Profit for the year 42,000 13,000

––––––– –––––––

The following information is also relevant:

(i) During November 20X5 Crab sold goods to Lobster for $10,000 at a

margin of 30%. At the reporting date, 40% of these goods had been sold

by Lobster.

Required:

Prepare the consolidated statement of profit or loss of Lobster for the

year ended 31 December 20X5.

339