Page 363 - F3 -FA Integrated Workbook STUDENT 2018-19

P. 363

Answers

Chapter 5

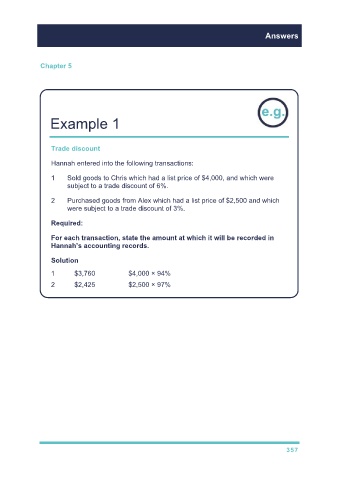

Example 1

Trade discount

Hannah entered into the following transactions:

1 Sold goods to Chris which had a list price of $4,000, and which were

subject to a trade discount of 6%.

2 Purchased goods from Alex which had a list price of $2,500 and which

were subject to a trade discount of 3%.

Required:

For each transaction, state the amount at which it will be recorded in

Hannah’s accounting records.

Solution

1 $3,760 $4,000 × 94%

2 $2,425 $2,500 × 97%

357