Page 406 - F3 -FA Integrated Workbook STUDENT 2018-19

P. 406

Chapter 24

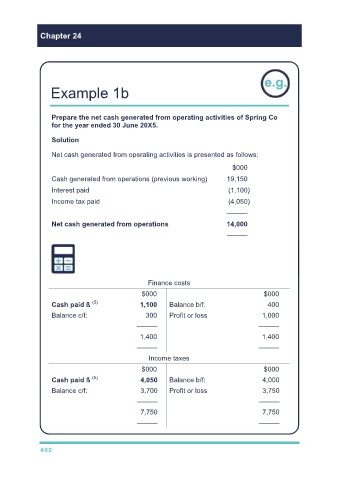

Example 1b

Prepare the net cash generated from operating activities of Spring Co

for the year ended 30 June 20X5.

Solution

Net cash generated from operating activities is presented as follows:

$000

Cash generated from operations (previous working) 19,150

Interest paid (1,100)

Income tax paid (4,050)

———

Net cash generated from operations 14,000

———

Finance costs

$000 $000

(5)

Cash paid ß 1,100 Balance b/f: 400

Balance c/f: 300 Profit or loss 1,000

——— ———

1,400 1,400

——— ———

Income taxes

$000 $000

(5)

Cash paid ß 4,050 Balance b/f: 4,000

Balance c/f: 3,700 Profit or loss 3,750

——— ———

7,750 7,750

——— ———

400