Page 410 - F3 -FA Integrated Workbook STUDENT 2018-19

P. 410

Chapter 24

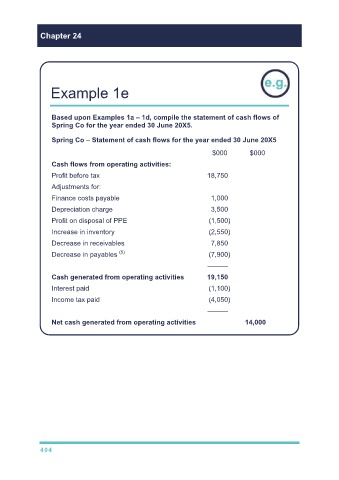

Example 1e

Based upon Examples 1a – 1d, compile the statement of cash flows of

Spring Co for the year ended 30 June 20X5.

Spring Co – Statement of cash flows for the year ended 30 June 20X5

$000 $000

Cash flows from operating activities:

Profit before tax 18,750

Adjustments for:

Finance costs payable 1,000

Depreciation charge 3,500

Profit on disposal of PPE (1,500)

Increase in inventory (2,550)

Decrease in receivables 7,850

Decrease in payables (5) (7,900)

———

Cash generated from operating activities 19,150

Interest paid (1,100)

Income tax paid (4,050)

———

Net cash generated from operating activities 14,000

404