Page 425 - F3 -FA Integrated Workbook STUDENT 2018-19

P. 425

Answers

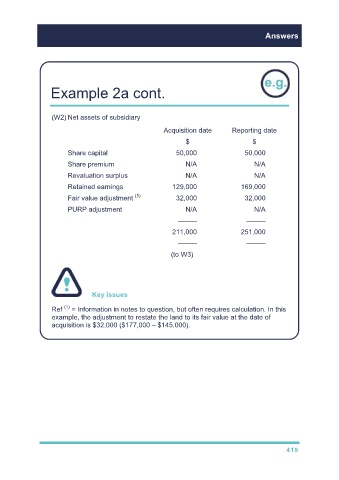

Example 2a cont.

(W2) Net assets of subsidiary

Acquisition date Reporting date

$ $

Share capital 50,000 50,000

Share premium N/A N/A

Revaluation surplus N/A N/A

Retained earnings 129,000 169,000

(1)

Fair value adjustment 32,000 32,000

PURP adjustment N/A N/A

––––– –––––

211,000 251,000

––––– –––––

(to W3)

Key issues

(1)

Ref = Information in notes to question, but often requires calculation. In this

example, the adjustment to restate the land to its fair value at the date of

acquisition is $32,000 ($177,000 – $145,000).

419