Page 429 - F3 -FA Integrated Workbook STUDENT 2018-19

P. 429

Answers

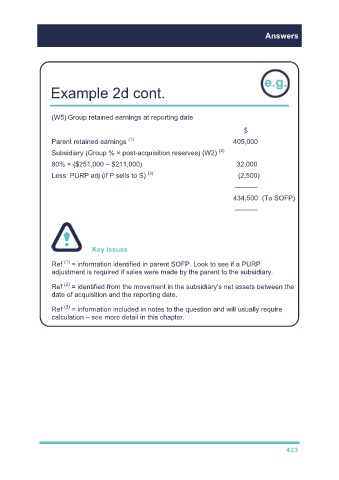

Example 2d cont.

(W5) Group retained earnings at reporting date

$

Parent retained earnings (1) 405,000

Subsidiary (Group % × post-acquisition reserves) (W2) (2)

80% × ($251,000 – $211,000) 32,000

Less: PURP adj (if P sells to S) (3) (2,500)

––––––

434,500 (To SOFP)

––––––

Key issues

(1)

Ref = information identified in parent SOFP. Look to see if a PURP

adjustment is required if sales were made by the parent to the subsidiary.

(2)

Ref = identified from the movement in the subsidiary’s net assets between the

date of acquisition and the reporting date.

(3)

Ref = information included in notes to the question and will usually require

calculation – see more detail in this chapter.

423