Page 436 - F3 -FA Integrated Workbook STUDENT 2018-19

P. 436

Chapter 24

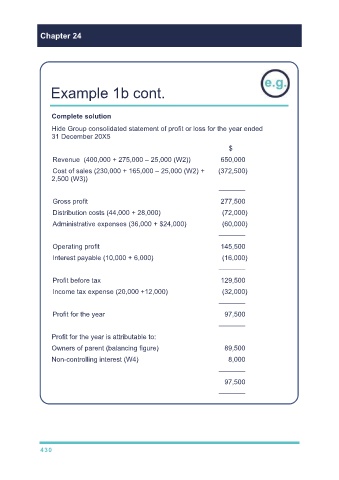

Example 1b cont.

Complete solution

Hide Group consolidated statement of profit or loss for the year ended

31 December 20X5

$

Revenue (400,000 + 275,000 – 25,000 (W2)) 650,000

Cost of sales (230,000 + 165,000 – 25,000 (W2) + (372,500)

2,500 (W3))

–––––––

Gross profit 277,500

Distribution costs (44,000 + 28,000) (72,000)

Administrative expenses (36,000 + $24,000) (60,000)

–––––––

Operating profit 145,500

Interest payable (10,000 + 6,000) (16,000)

–––––––

Profit before tax 129,500

Income tax expense (20,000 +12,000) (32,000)

–––––––

Profit for the year 97,500

–––––––

Profit for the year is attributable to:

Owners of parent (balancing figure) 89,500

Non-controlling interest (W4) 8,000

–––––––

97,500

–––––––

430