Page 439 - F3 -FA Integrated Workbook STUDENT 2018-19

P. 439

Answers

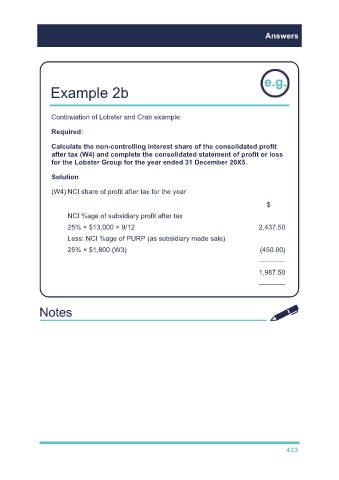

Example 2b

Continuation of Lobster and Crab example:

Required:

Calculate the non-controlling interest share of the consolidated profit

after tax (W4) and complete the consolidated statement of profit or loss

for the Lobster Group for the year ended 31 December 20X5.

Solution

(W4) NCI share of profit after tax for the year

$

NCI %age of subsidiary profit after tax

25% × $13,000 × 9/12 2,437.50

Less: NCI %age of PURP (as subsidiary made sale)

25% × $1,800 (W3) (450.00)

–––––––

1,987.50

–––––––

433