Page 25 - FINAL CFA II SLIDES JUNE 2019 DAY 8

P. 25

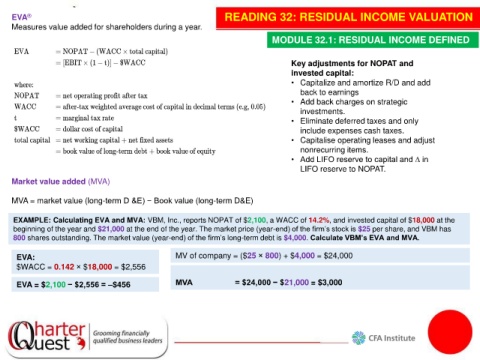

EVA ® READING 32: RESIDUAL INCOME VALUATION

Measures value added for shareholders during a year.

MODULE 32.1: RESIDUAL INCOME DEFINED

Key adjustments for NOPAT and

invested capital:

• Capitalize and amortize R/D and add

back to earnings

• Add back charges on strategic

investments.

• Eliminate deferred taxes and only

include expenses cash taxes.

• Capitalise operating leases and adjust

nonrecurring items.

• Add LIFO reserve to capital and ∆ in

LIFO reserve to NOPAT.

Market value added (MVA)

MVA = market value (long-term D &E) − Book value (long-term D&E)

EXAMPLE: Calculating EVA and MVA: VBM, Inc., reports NOPAT of $2,100, a WACC of 14.2%, and invested capital of $18,000 at the

beginning of the year and $21,000 at the end of the year. The market price (year-end) of the firm’s stock is $25 per share, and VBM has

800 shares outstanding. The market value (year-end) of the firm’s long-term debt is $4,000. Calculate VBM’s EVA and MVA.

EVA: MV of company = ($25 × 800) + $4,000 = $24,000

$WACC = 0.142 × $18,000 = $2,556

EVA = $2,100 − $2,556 = –$456 MVA = $24,000 − $21,000 = $3,000