Page 28 - FINAL CFA II SLIDES JUNE 2019 DAY 8

P. 28

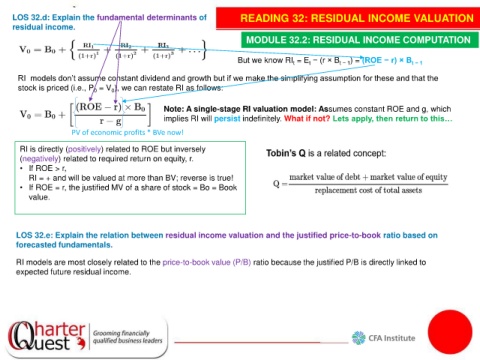

LOS 32.d: Explain the fundamental determinants of READING 32: RESIDUAL INCOME VALUATION

residual income.

MODULE 32.2: RESIDUAL INCOME COMPUTATION

But we know RI = E − (r × B t − 1 ) = (ROE − r) × B t − 1

t

t

RI models don’t assume constant dividend and growth but if we make the simplifying assumption for these and that the

stock is priced (i.e., P = V ), we can restate RI as follows:

0

0

Note: A single-stage RI valuation model: Assumes constant ROE and g, which

implies RI will persist indefinitely. What if not? Lets apply, then return to this…

PV of economic profits * BVe now!

RI is directly (positively) related to ROE but inversely

(negatively) related to required return on equity, r.

• If ROE > r,

RI = + and will be valued at more than BV; reverse is true!

• If ROE = r, the justified MV of a share of stock = Bo = Book

value.

LOS 32.e: Explain the relation between residual income valuation and the justified price-to-book ratio based on

forecasted fundamentals.

RI models are most closely related to the price-to-book value (P/B) ratio because the justified P/B is directly linked to

expected future residual income.