Page 3 - FINAL CFA II SLIDES JUNE 2019 DAY 8

P. 3

LOS 31.a: Distinguish between the method of READING 31: MARKET-BASED VALUATION: PRICE AND

comparables and the method based on forecasted ENTERPRISE VALUE MULTIPLES

fundamentals as approaches to using price multiples

in valuation, and explain economic rationales for MODULE 31.1: P/E MULTIPLE

each approach.

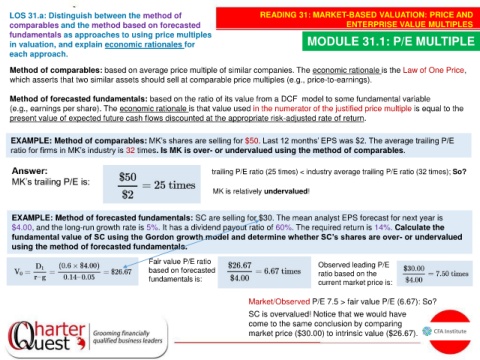

Method of comparables: based on average price multiple of similar companies. The economic rationale is the Law of One Price,

which asserts that two similar assets should sell at comparable price multiples (e.g., price-to-earnings).

Method of forecasted fundamentals: based on the ratio of its value from a DCF model to some fundamental variable

(e.g., earnings per share). The economic rationale is that value used in the numerator of the justified price multiple is equal to the

present value of expected future cash flows discounted at the appropriate risk-adjusted rate of return.

EXAMPLE: Method of comparables: MK’s shares are selling for $50. Last 12 months’ EPS was $2. The average trailing P/E

ratio for firms in MK’s industry is 32 times. Is MK is over- or undervalued using the method of comparables.

trailing P/E ratio (25 times) < industry average trailing P/E ratio (32 times); So?

MK is relatively undervalued!

EXAMPLE: Method of forecasted fundamentals: SC are selling for $30. The mean analyst EPS forecast for next year is

$4.00, and the long-run growth rate is 5%. It has a dividend payout ratio of 60%. The required return is 14%. Calculate the

fundamental value of SC using the Gordon growth model and determine whether SC’s shares are over- or undervalued

using the method of forecasted fundamentals.

Fair value P/E ratio Observed leading P/E

based on forecasted ratio based on the

fundamentals is: current market price is:

Market/Observed P/E 7.5 > fair value P/E (6.67): So?

SC is overvalued! Notice that we would have

come to the same conclusion by comparing

market price ($30.00) to intrinsic value ($26.67).