Page 6 - FINAL CFA II SLIDES JUNE 2019 DAY 8

P. 6

LOS 31.b: Calculate and interpret a justified price multiple. READING 31: MARKET-BASED VALUATION: PRICE AND

LOS 31.c: Describe rationales for and possible drawbacks ENTERPRISE VALUE MULTIPLES

to using alternative price multiples and dividend yield in

valuation. MODULE 31.2: P/B MULTIPLE

LOS 31.d: Calculate and interpret alternative price multiples

and dividend yield.

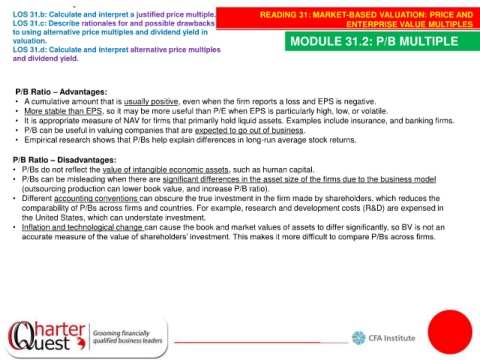

P/B Ratio – Advantages:

• A cumulative amount that is usually positive, even when the firm reports a loss and EPS is negative.

• More stable than EPS, so it may be more useful than P/E when EPS is particularly high, low, or volatile.

• It is appropriate measure of NAV for firms that primarily hold liquid assets. Examples include insurance, and banking firms.

• P/B can be useful in valuing companies that are expected to go out of business.

• Empirical research shows that P/Bs help explain differences in long-run average stock returns.

P/B Ratio – Disadvantages:

• P/Bs do not reflect the value of intangible economic assets, such as human capital.

• P/Bs can be misleading when there are significant differences in the asset size of the firms due to the business model

(outsourcing production can lower book value, and increase P/B ratio).

• Different accounting conventions can obscure the true investment in the firm made by shareholders, which reduces the

comparability of P/Bs across firms and countries. For example, research and development costs (R&D) are expensed in

the United States, which can understate investment.

• Inflation and technological change can cause the book and market values of assets to differ significantly, so BV is not an

accurate measure of the value of shareholders’ investment. This makes it more difficult to compare P/Bs across firms.